S&U is a niche lender in the UK with a subprime used car lending business, Advantage, and a burgeoning bridge lending business in residential development, Aspen. While Aspen is growing rapidly, Advantage still accounts for the lion's share of S&U's profitability.

There are some good write-ups that set out why S&U is a great business. Here's one.

I want to drill down here into one aspect of Advantage in particular: the margin of safety in its lending. I'm going to do this by comparing it with a company familiar with many US investors, Credit Acceptance Corp (CACC).

A margin of safety in lending can be thought of in the same way as in investing. You want to pay far less for a future stream of cash flows than you think they are worth. In lending this equates to advancing a much smaller sum to the borrower than you expect to collect over the loan life - the difference between these two amounts being the effective interest you earn on the amount borrowed.

A margin of safety is especially important in subprime lending because the underwriting is trickier. You are fishing in a pool of riskier borrowers for the 'golden nuggets' as S&U puts it, so there is more scope for bigger mistakes.

CACC does a very good job of explaining its business in its shareholder letters and 10-K. What stands out it its ability to make consistently high returns on capital while exposing itself to little downside risk because of the margin of safety in its lending.

S&U's management is very transparent. Its annual reports are simple, its investor presentations are factual, and management is accessible. But it does not set out its stall as well as CACC so I have worked out the numbers that do, in particular its margin of safety using CACC's approach.

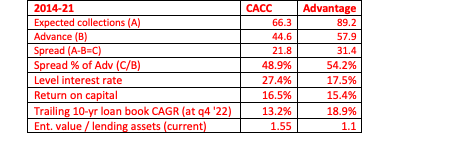

So let's look at the key numbers for CACC and S&U:

Spread is the margin of safety. It is the difference between the advance - the amount lent to the borrower - and the total expected collections on the loan (whether from repayments or recoveries on repossession or voluntary termination), both expressed as a percentage of the total contractually owed amounts - ie the total interest and principal repayments due over the loan life.

CACC discloses its expected collections. S&U does so indirectly. In its annual results presentation (page 16 of FY22's), it presents historic collection data that can be used to derive expected collections. I only have these going back to 2014.

The level interest rate expresses the total interest to be paid over the loan life as a constant rate of interest on the initial advance.

Return on capital is pre-tax, pre-interest return divided by average annual net loan balances.

To derive Advantage's implied enterprise value I have taken S&U's market cap of £250m and debt of £180m and deducted Aspen's net loan book of £108m without according it any premium. This yields a multiple of 1.1x Advantage's current net loan book of £296m.

The key takeaway here is that Advantage has a higher margin of safety in its lending than CACC and makes almost the same return on capital, but CACC trades at a healthy premium to Advantage. S&U's implied share price with Advantage valued at CACC's rating is £32 per share, 50% above the current share price. While I do not believe this number adequately reflects Advantage and Aspen's potential growth, it does serve to illustrate the straight valuation discrepancy between two similar businesses.

Whilst CACC has a slightly higher return on capital, Advantage has higher loan book growth. I do not see this growth being constrained as, at 30%, used car loan penetration in the UK is lower than in the US. Also, Advantage's main competitor and the market leader, Moneybarn, has been steadily repositioning its book towards near prime in recent years. I believe the PRA's decision to allow Moneybarn within Provident Financials’ ringfence will only reinforce this.

Furthermore, Advantage is lending to better quality borrowers. We can see this by comparing the level interest rates and expected collection percentages. Advantage expects to collect a far higher proportion of its contractual repayments than CACC. Its loans are therefore more affordable than CACC's, which exposes it to less regulatory risk.

It is often argued by CACC's investors and CACC itself that its superior returns are partly down to dealer captivity, whereby dealers in its program are paid some of the return on the loan once CACC has received a certain amount. It is argued this aligns dealers' incentives with CACC's and attracts dealers because of the economics, giving CACC a moat. I do not believe this assertion stands up to scrutiny as dealer churn is high and CACC does 30-40% of its lending outside this program. Furthermore, it did not save CACC from making losses because of bad loans in the late 1990s. I believe in both CACC's and S&U's case the superior returns have a simpler explanation: good underwriting.

Great post! If you have the chance I think it will be interesting to check GOEASY (GSY) in Canada. Same sector as SUS and CACC with a great management.